Cryptocurrencies Shared irresponsibility

Cryptocurrencies are not subject to centralised governance. The community holds the power – but fails to do all that needs to be done. As a result, the collateral of the currency might be at risk.

Bitcoin, Litecoin, Dogecoin, Digibyte – the list of all currently existing cryptocurrencies is very long. So long, in fact, that it would be hard to decipher their names if they were all squeezed onto one A4 page. Thousands of virtual currencies are out there, and they have long ceased to be a niche product. Millions of people use them. When using cryptocurrencies, IT security is of paramount importance. After all, money is nothing more than data, which, like all data, is potentially vulnerable to cyberattacks.

Professor Ghassan Karame addresses the question of how watertight various cryptocurrencies really are. He heads the Chair for Information Security at Ruhr University Bochum and is an advocate for decentralised platforms, like the ones on which cryptocurrencies are based. The idea behind it is simple: power is not bundled in one central entity, for example in a bank. Rather, decisions are always made by some majority of users. “In such systems, it should be very hard for a central body to impose censorship, and they are robust against faults and misbehaviour because a large community of developers monitors the technology,” as Karame outlines two advantages of decentralised platforms. “The idea is brilliant, and more likely than not, it is the future,” he adds. Just like any other IT technology, however, cryptocurrencies are also vulnerable to security breaches.

Critical security vulnerabilities in cryptocurrencies

As early as 2012, Karame and his collaborators detected a critical issue in the usage of the Bitcoin system that allowed people to spend the same Bitcoins multiple times to pay for different transactions. “It was as though you could buy a burger with a five-euro note and then use the same note again to pay for an ice cream,” explains the researcher.

Cryptocurrencies

In 2015, Karame and his collaborators documented another critical vulnerability that emerged after Bitcoin adapted its system to a larger number of users. “We showed that if we had control over as few as tens of laptops in the system, we could stop information flow in the entire Bitcoin system,” as Ghassan Karame describes the severity of the vulnerability. Bitcoin has long since addressed both security gaps.

Reporting errors can be a problem

But Bitcoin is not the only currency out there, there are plenty of copies floating around. The source code for Bitcoin is freely available on the internet. Anyone can copy it and launch their own cryptocurrency. This is how Dogecoin was created, for example, which has become the No. 1 cryptocurrency in the gaming industry. “There are so many cryptocurrencies that we don’t even know all of them, and we certainly don’t know who is running them,” points out Karame. That’s the trouble with decentralised systems. Since decision-making power is shared, it is complicated for researchers to report security vulnerabilities.

IT security is governed by the ethical imperative of “responsible disclosure”. If a security vulnerability is detected and confirmed, the researchers must always notify the operator of the compromised product first and allow them sufficient time to fix the bug before it is publicly disclosed. This is to ensure that the exposures are patched before attackers can exploit them.

But to whom are you supposed to report errors in a decentralised system, when it sometimes isn’t even clear who is running the system? Or if you don’t even know how many and which systems are affected? Who decides in such a structure whether the software has to be updated to close security gaps? And how can you control whether a vulnerability has been patched? There are no answers to these questions yet.

Three years until security update

Regarding the security vulnerabilities described above, Karame and his collaborators were in discussion with the various Bitcoin developers. “There, the staff responded diligently and swiftly,” he recalls. But no advance warning ever came for the numerous copies of Bitcoin. Ghassan Karame intends to find out what the real-world impact of these unclear structures really is. He and his team examined various virtual currencies that are slightly modified copies of Bitcoin. They are widely known under the umbrella term “altcoins”. The researchers checked how long it took until security vulnerabilities in various altcoin source codes were closed after they had transpired – including the serious security vulnerability detected by Karame’s team and disclosed in 2015, for example.

The results were a shock.

Ghassan Karame

“In a nutshell: the results were a shock,” as Ghassan Karame puts it. While Bitcoin fixed the vulnerability in just seven days, it took, for example, Litecoin 114 days, Dogecoin 185 days and Digibyte almost three years. “Three years in which you could have crashed the entire cryptocurrency system with tens of laptops,” Ghassan Karame points out and illustrates the scale of the problem: “Imagine if it took Visa three years to fix a security flaw in credit card payments.”

Time-consuming analysis

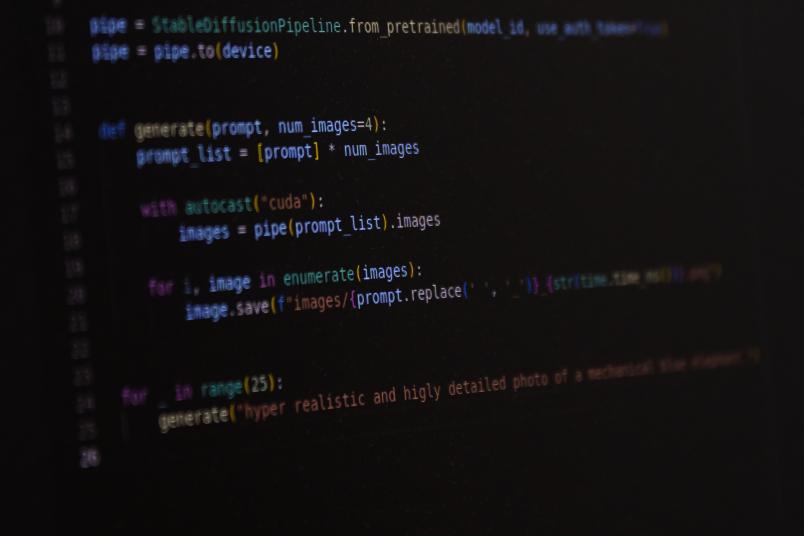

The result of the analysis made in Bochum sounds simple, but the path to the numbers was lengthy. Bitcoin’s full source code as well as each modification of the code are freely available on a platform called “GitHub”. This offers multiple opportunities for cloning and importing patches from this public project. For example, anyone who wants to create a Bitcoin copy, i.e. an altcoin, can copy the source code in GitHub into their own project using a simple command.

If a security update for Bitcoin is available and an altcoin developer decides to install it, they typically use the “rebase” command. This means they don’t have to laboriously rewrite their own code, but can transfer the necessary information directly from the Bitcoin code to the own. The researchers identified the problem as follows: while GitHub typically tracks the timestamp of each code modification, the use of the rebase command can result in the loss of this metadata. As a result, it’s no longer straightforward to tell from the source code when a security update was implemented.

Therefore, the team had first of all to develop a tool with which they could approximate the time of a security update for forked source code. The tool is based on an existing archive service that keeps track of all events on public repositories of GitHub, such as modifying the code or perform a rebase operation. This allowed the researchers to match updates in the code with the respective events in the archive, in order to estimate the timestamp of the security patch.

Just the tip of the iceberg

This is how the researchers analysed 44 of the most serious security vulnerabilities documented for Bitcoin and altcoins. Invariably, the same pattern emerged over and over again: for many altcoins, the number of days it took to fix the flaws was in the three-digit or even four-digit range. “We believe that some cryptocurrencies haven’t managed to patch some of the vulnerabilities to this day,” says Karame. He’s certain that the problem is actually much more serious than his initial analysis showed. “I’m almost afraid to dig down any deeper,” he continues. “We’ve seen only the tip of the iceberg so far, I’m sure.” Therefore, the researcher urges caution: “Users need to be more careful when picking a cryptocurrency. They shouldn’t base their decision solely on the prospects of profit. It’s no use at all to make a bunch of money if it can disappear in a puff of smoke the next day due to a security breach.” In theory, people should only trade cryptocurrencies whose operators have a policy of security updates. Currently, however, users have little chance of finding out whether this is the case. It remains to be seen whether this gap will be closed when decentralised platforms become even more popular.